The Business of an Accounting Firm: Building a Successful Practice

The Business of an Accounting Firm: Building a Successful Practice Accounting firms are a cornerstone of the global economy, providing essential services to individuals, businesses, and organizations alike. From tax preparation to financial consulting, the industry is integral to maintaining financial integrity, transparency, and compliance. But beyond just the numbers, running an accounting firm involves a unique set of challenges and opportunities that demand strategic management, exceptional customer service, and a keen understanding of market trends.

In this blog post, we’ll explore the key aspects of the business of an accounting firm, including the necessary steps to build a successful firm, how to scale the business, and ways to stay competitive in a rapidly changing industry.

1. Defining the Services Offered

The Business of an Accounting Firm The foundation of any accounting firm starts with clearly defining the services it offers. Firms can specialize in one or multiple areas, such as:

Tax services (business and personal tax filings)

Audit services (internal and external audits)

Forensic accounting (fraud investigation)

Consulting (financial advisory, business strategy, mergers, and acquisitions)

Bookkeeping (monthly or quarterly record-keeping)

Financial planning (personal or business wealth management)

By narrowing down on specific services, accounting firms can build their reputation and attract the right clients. Offering specialized services often helps firms stand out in a competitive market.

2. Creating a Strong Brand and Client Base

The Business of an Accounting Firm Building trust with clients is at the core of any successful accounting firm. Establishing a strong brand identity is crucial. Your firm needs to have a recognizable name, a professional logo, and a compelling story about why clients should choose you over competitors.

Customer acquisition begins with offering value from day one. Here are a few ways to build and maintain a solid client base:

Networking: Attend industry events and seminars to meet potential clients. Many accounting professionals generate leads through personal connections.

Referrals: Word-of-mouth and client referrals are vital in the accounting industry. Satisfied clients are often willing to refer your services to others.

Digital presence: An up-to-date website and a strong social media presence help boost your firm’s credibility. Offering helpful tips through blogs, videos, or infographics can attract potential clients online.

A solid client base not only ensures a steady revenue stream but can also lead to long-term, recurring business through ongoing tax filings, audits, or financial advisory services.

3. Team Building and Talent Acquisition

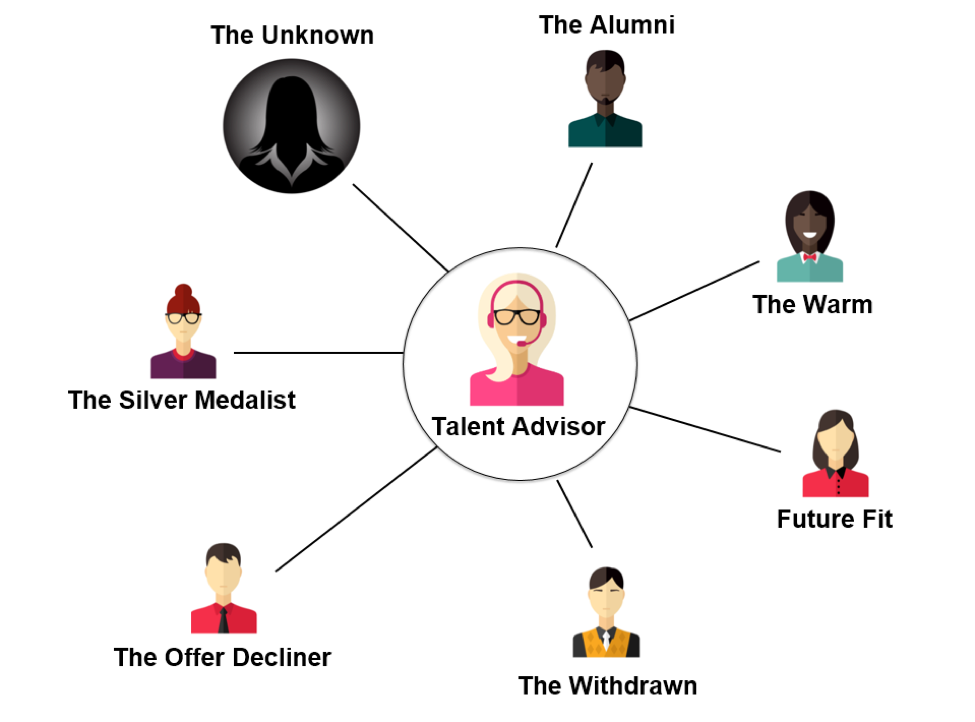

The Business of an Accounting Firm As with any business, the success of an accounting firm depends on the team behind it. Your staff must be highly skilled in various aspects of accounting and finance, and they need to be committed to upholding the firm’s values and standards. Hiring the right talent can be challenging, but it’s critical to the firm’s growth and reputation.

Additionally, investing in employee development programs can help retain top talent. Providing certifications, encouraging continuous learning, and offering growth opportunities will motivate employees to stay with the firm.

4. Managing Firm Operations Efficiently

The business of an accounting firm involves much more than client work. Efficient internal operations are crucial to ensure smooth functioning and profitability. This includes managing day-to-day tasks such as:

Client onboarding: Have a standardized system in place to manage new clients, contracts, and engagements.

Time management: Time is money in an accounting firm, so adopting tools to track billable hours, invoicing, and deadlines is crucial.

Accounting software: Utilize industry-standard accounting software for handling complex financial data, tax preparation, and payroll services. Automation tools can save time and reduce human error.

Compliance: Staying up to date with ever-changing tax laws, financial regulations, and audit standards is critical to avoid legal issues and penalties.

In addition, developing an efficient workflow system for each of the services you provide will enhance both employee satisfaction and client experience.

5. Marketing and Growth Strategies

The Business of an Accounting Firm As your accounting firm matures, it will be important to implement scalable marketing strategies that help to attract more clients and expand your business. Consider the following approaches:

Local SEO: A significant number of accounting clients search for firms near their location. By optimizing your website for local search terms, you can attract more local business.

Content marketing: Providing valuable financial advice through blog posts, social media posts, or webinars can position your firm as an industry expert and help with SEO.

Partnerships: Partnering with other professional service providers, such as lawyers or financial advisors, can lead to client referrals and networking opportunities.

You may also want to consider diversifying your services to cater to a wider client base. For example, offering payroll processing, business consulting, or virtual CFO services can add multiple streams of revenue to your practice.

6. Adapting to Technology and Industry Trends

The Business of an Accounting Firm The accounting industry is evolving, and staying ahead of the curve is essential. The use of technology is drastically changing the way accounting firms operate. Cloud-based accounting software, AI, and automation tools are helping firms streamline their operations, provide better client experiences, and reduce the likelihood of errors.

Here are some trends to watch out for:

Artificial Intelligence (AI) and Machine Learning: These technologies can automate repetitive tasks such as bookkeeping, invoicing, and data entry, freeing up time for more strategic work.

Blockchain: Although still in its early stages in the accounting industry, blockchain technology has the potential to revolutionize the way firms handle financial transactions, improving transparency and security.

Cloud accounting: More and more businesses are migrating to the cloud for data storage and financial management. Offering cloud-based services to clients will provide them with real-time access to their financial data, improving collaboration.

Adapting to and embracing these technologies can significantly enhance the value of your firm’s offerings, making it more competitive in the industry.

7. Scaling Your Firm

The Business of an Accounting Firm Once your firm becomes established and steady, growth should be a major consideration. Scaling your accounting firm involves expanding your client base, increasing revenue, and hiring additional employees to handle the increased workload.

Some strategies for scaling include:

Outsourcing: Outsourcing specific tasks, like bookkeeping or payroll, to independent contractors or other firms can help reduce overhead costs.

Acquiring smaller firms: If you’re looking to expand quickly, acquiring smaller firms with complementary services or client bases can be an efficient way to grow.

Expanding into new markets: Geographical expansion can open up new revenue streams. Consider offering your services in new cities, states, or even internationally.

Scaling also requires systems in place to manage growth, from new client onboarding to managing a larger staff.

Conclusion

The Business of an Accounting Firm The business of an accounting firm requires a careful balance of client service, efficient operations, and strategic growth. While the technical expertise in accounting is essential, understanding the business side of running a firm is equally important for long-term success. By defining your services, building a strong brand, investing in your team, and adapting to industry changes, your firm will be better positioned to thrive in today’s competitive marketplace