Understanding the Federal Tax Authority: An Overview

Understanding the Federal Tax Authority The federal tax authority plays a vital role in the economic structure of any country. In the United States, the federal tax authority is known as the Internal Revenue Service (IRS), and it is responsible for administering and enforcing federal tax laws. But what exactly does the IRS do, how does it impact taxpayers, and what role does it play in the economy? In this blog, we’ll break it down for you.

What is the Federal Tax Authority?

Understanding the Federal Tax Authority At its core, the federal tax authority is a governmental agency that ensures the collection of taxes, the enforcement of tax laws, and the administration of various federal revenue programs. The U.S. Internal Revenue Service, or IRS, falls under the Department of the Treasury and is tasked with administering tax laws set by Congress.

Federal taxes are essential because they fund the operations of the government, from public services and infrastructure to social programs like Social Security and healthcare. Without a reliable system to collect taxes, these services would be underfunded, affecting citizens’ daily lives.

Functions of the Federal Tax Authority

Tax Collection: The IRS is responsible for ensuring that individuals, businesses, and organizations comply with tax laws and pay their taxes on time. This includes income tax, corporate tax, and other types of federal taxes.

Tax Enforcement: The IRS has the authority to conduct audits and investigations to ensure that taxpayers are not underreporting their income or overclaiming deductions. If taxes are owed, the agency can take enforcement actions, including penalties, liens, and, in some cases, criminal charges.

Taxpayer Assistance: The IRS provides resources to help taxpayers understand their obligations, such as guides on how to file returns, how to apply for deductions, and what to do in the case of a tax audit. They also offer payment plans for individuals who cannot pay their taxes in full.

Tax Law Interpretation: The IRS helps interpret and apply the ever-evolving tax laws. With tax laws frequently changing, the IRS issues notices, bulletins, and regulations to ensure clarity for taxpayers.

Administering Refunds: If taxpayers overpay their taxes throughout the year, the IRS processes refunds, often in the form of direct deposits. These refunds help balance out the tax burden and provide financial relief.

Promoting Tax Compliance: The IRS also focuses on educating the public about the importance of tax compliance. They encourage voluntary compliance by making the tax process simpler and providing incentives for those who adhere to tax laws.

Why is the Federal Tax Authority Important?

Understanding the Federal Tax Authority Funding Government Programs: Federal taxes fund a wide array of programs that benefit the public, including infrastructure projects, defense, education, healthcare, and social safety nets. Without efficient tax collection, these programs could face serious budget cuts or even be entirely defunded.

Economic Stability: Taxes help regulate inflation and stabilize the economy. The federal tax system plays a role in managing the country’s economy by affecting consumer behavior, investments, and business decisions. By adjusting tax rates, the government can influence the economy’s growth or slow it down when necessary.

Ensuring Fairness: One of the central principles behind the federal tax authority is ensuring fairness in the tax system. The IRS works to ensure that all taxpayers contribute their fair share, with systems in place to address non-compliance and fraudulent activities. Taxes are often based on income or property values, so those who earn more or have more assets typically pay higher amounts.

Support for Social Programs: The taxes collected also go toward funding essential social programs, including Social Security, Medicare, and Medicaid, which help elderly individuals, people with disabilities, and those with lower incomes. These programs provide a safety net for millions of Americans.

Common Federal Taxes You Might Encounter

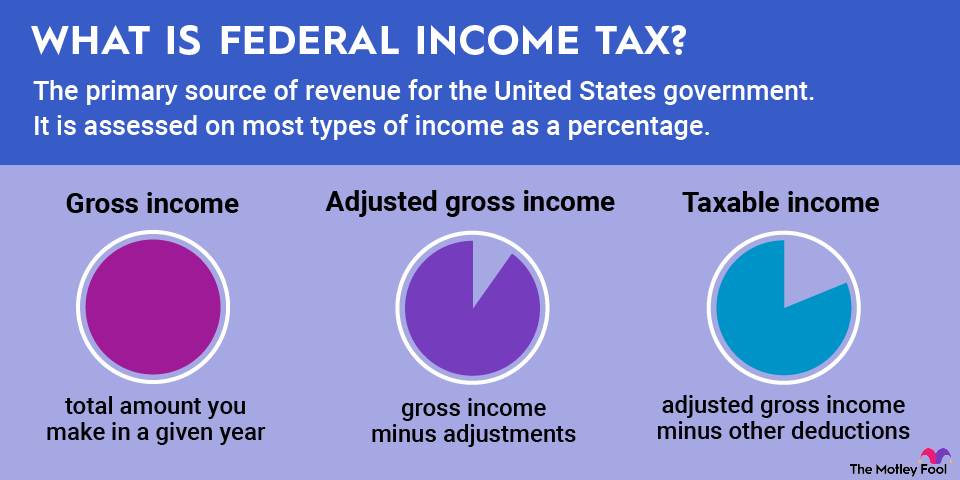

Income Tax: The most common form of taxation, applied to the income you earn, whether it’s from a job, business, or investments.

Payroll Taxes: These include Social Security and Medicare taxes, which are automatically withheld from your paycheck by your employer.

Corporate Tax: Businesses are required to pay taxes on their profits.

Capital Gains Tax: If you sell an asset such as a house, stocks, or bonds for a profit, the IRS taxes that profit.

Estate and Gift Taxes: These taxes are levied on the transfer of wealth through inheritance or gifts above a certain value.

How Does the IRS Ensure Compliance?

Understanding the Federal Tax Authority The IRS uses several mechanisms to ensure tax compliance and accountability:

Tax Audits: The IRS may review a taxpayer’s financial information and tax returns to confirm that they are paying the correct amount of tax. These audits can be random or based on red flags in a taxpayer’s return.

Penalties and Interest: If taxes are owed, the IRS can impose fines, interest, and penalties. The longer a taxpayer delays payment, the more they may owe due to these additional charges.

Taxpayer Assistance and Education: The IRS provides a wealth of resources to help taxpayers, from IRS websites with FAQs to dedicated helplines and even online tools to calculate tax liabilities and file returns.

Enforcement Actions: If a taxpayer refuses to pay or fails to comply with tax laws, the IRS can initiate collection actions. This includes garnishing wages, placing liens on property, and, in extreme cases, pursuing criminal charges.

The Future of Federal Tax Authorities

Understanding the Federal Tax Authority As the global economy continues to evolve, so too does the tax system. In recent years, the IRS has made efforts to modernize its operations by embracing technology. E-filing and direct deposit refunds have become standard, and the IRS is constantly adapting to new forms of income, such as cryptocurrency.

There is also a growing conversation about tax reform, with ongoing debates about simplifying the tax code and ensuring fairness in the distribution of tax burdens across different socioeconomic classes.