Accounting and Payroll Management for Dubai-Based Companies: A Complete Guide

Dubai’s dynamic and rapidly growing economy makes it a prime location for businesses across industries. Whether you’re a startup, SME, or a multinational enterprise, having solid financial systems is crucial. One of the most essential aspects of managing business finances is accounting and payroll management.

In this guide, we’ll explore why accounting and payroll management is so important in Dubai, the local regulatory requirements, and how businesses can streamline these functions for growth and compliance.

Why Accounting and Payroll Management Matter in Dubai

Accounting and payroll management are the financial backbone of any organization. In Dubai, the stakes are even higher due to specific regulatory frameworks, including VAT laws, corporate tax implementation, and labor law compliance.

Accounting and Payroll Management for Dubai

Benefits of Effective Accounting:

-

Accurate financial reporting

-

Better decision-making through cash flow and profit analysis

-

Compliance with UAE tax and audit laws

-

Easier access to financing or investor support

Benefits of Payroll Management:

-

Timely and accurate salary payments

-

Compliance with WPS (Wage Protection System)

-

Employee satisfaction and trust

-

Avoidance of penalties and labor disputes

Regulatory Environment in Dubai

1. VAT Compliance

Since 2018, VAT (Value Added Tax) at 5% applies to most goods and services in the UAE. Businesses must:

Accounting and Payroll Management for Dubai

-

Register for VAT if annual turnover exceeds AED 375,000

-

File regular VAT returns

-

Maintain clear records of invoices and expenses

2. Corporate Tax Implementation

Starting in 2023, UAE introduced a 9% corporate tax for businesses earning over AED 375,000 annually. Accurate accounting is now more crucial than ever for tax planning and filing.

3. Wage Protection System (WPS)

The UAE Ministry of Human Resources and Emiratisation mandates that employee salaries must be processed through the WPS. Late or inaccurate payments can lead to fines or company bans.

4. End of Service Benefits

Employers must calculate and pay gratuity (end-of-service benefits) for eligible employees. This is a legal obligation and requires precise payroll records.

Challenges Faced by Dubai-Based Businesses

Accounting and Payroll Management for Dubai

-

Complex tax calculations with new corporate tax laws

-

Managing multi-currency payrolls for international teams

-

Frequent regulation updates that require expert oversight

-

Risk of non-compliance due to poor record-keeping

-

Lack of in-house expertise in accounting software and systems

Key Components of Accounting & Payroll Management

Accounting Services May Include:

-

Bookkeeping

-

VAT return filing

-

Audit preparation

-

Financial reporting

-

Budgeting and forecasting

-

Cash flow management

-

Corporate tax return preparation

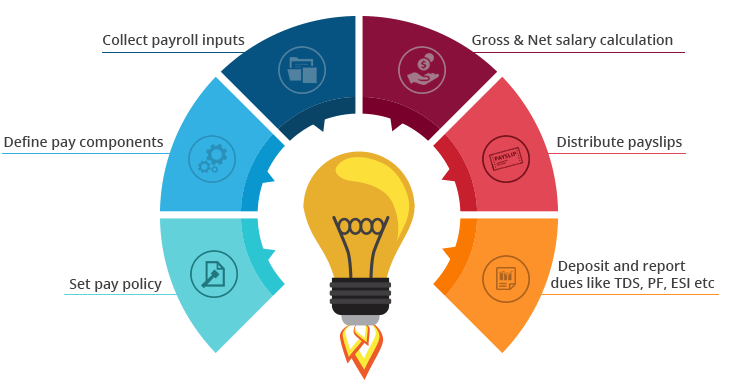

Payroll Management May Include:

-

Monthly salary processing

-

WPS compliance

-

Payslip generation

-

Leave and overtime tracking

-

Employee benefits administration

-

Gratuity calculation

-

HR and compliance reports

Why Outsource Accounting and Payroll in Dubai?

Many businesses in Dubai are turning to outsourced accounting and payroll services to reduce costs and improve efficiency. Here’s why:

Accounting and Payroll Management for Dubai

-

Access to expertise in UAE tax laws and labor regulations

-

Cost-effective compared to hiring full-time staff

-

Use of modern accounting tools like Zoho Books, QuickBooks, or Xero

-

Data security and confidentiality

-

Scalability with business growth

How to Choose the Right Accounting and Payroll Partner in Dubai

When selecting a service provider, consider:

-

Experience in UAE market and regulations

-

Certifications and industry accreditations

-

Software tools they use

-

Client reviews and testimonials

-

Transparent pricing models

Best Practices for Efficient Accounting and Payroll

-

Automate recurring tasks using cloud software.

-

Maintain digital records for at least five years (as per UAE law).

-

Set calendar reminders for tax deadlines and payroll runs.

-

Conduct internal audits quarterly to check for errors.

-

Train HR and admin teams on payroll compliance basics.

-

Use secure portals for employee payslips and records.

Final Thoughts

Accounting and payroll management in Dubai isn’t just about number crunching—it’s about ensuring financial health, regulatory compliance, and employee satisfaction. Whether you handle it in-house or outsource to experts, getting it right is non-negotiable for long-term success.

If you’re a business owner in Dubai and want to ensure compliance while freeing up your time for growth, consider partnering with a trusted accounting and payroll service provider.